Bringing Vignettes to Life

Prince, The Watchdog of the Bank

ANIMALS APPEAR in a wide variety of situations and motifs on fiscal paper. Livestock and other ruminants typically serve to illustrate agricultural bounty or evoke pastoral settings. Some animals symbolize a place itself, like the otter on checks from the Bank of Otterville, Missouri. Robert Eberhard Launitz’s statue of Leatherstocking, which appeared for decades on checks of the First National Bank of Cooperstown, N.Y., depicts Natty Bumppo and Hector, the hunting dog gazing up in abject adoration at his master. Otherwise, canines are often used to portray some behavior or attitude that we value in banking and finance: loyalty, protectiveness, and vigilance. Variations on the vignette of a dog, perched upon a strongbox and guarding its key, are perhaps the most characteristic expressions of these traits.

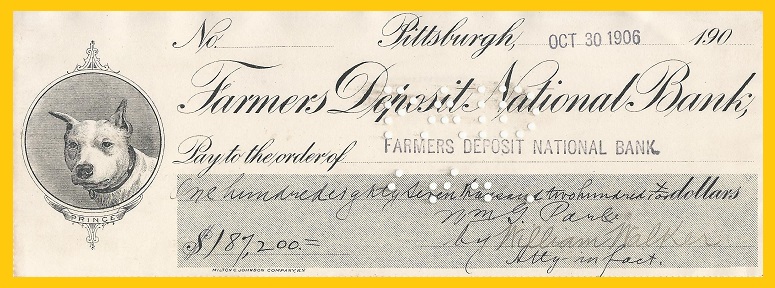

A vignette of Prince, on a check for a princely sum, 1906.

(Image source: author's collection)

For the most part, these dogs were at best anonymous models for the engraver’s art. Not so with Prince, the English bull terrier gracing this check drawn in 1906 on the Farmers Deposit National Bank of Pittsburgh, Pennsylvania. Prince not only existed, but bestrode the lobby and corridors of that Pittsburgh bank for the better part of the 1890s. Originally a gift to the bank’s cashier and later president, T. H. Given, Prince became a denizen of the bank, wandering its premises freely as a gentle friend to children and a fierce foe of enemies.

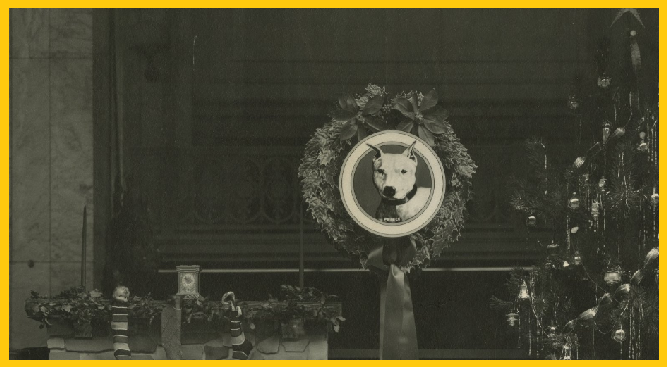

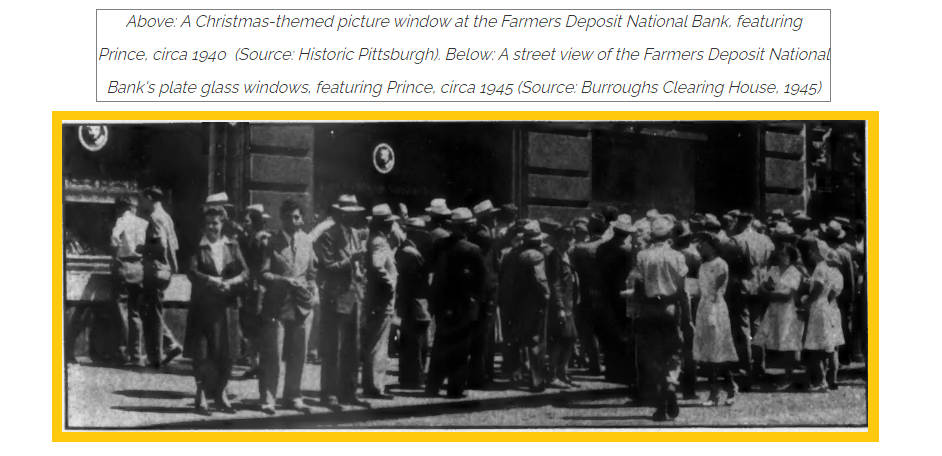

Although the dog disappeared mysteriously in 1898, the memory of Prince lived on and was indeed burnished as an icon of the bank’s corporate identity. Images of Prince appeared not only on checks, calendars, stationery, and other documents of the bank, but on its stock certificates themselves. When Given had the new Farmers Deposit Building constructed in 1902, it was the tallest skyscraper between New York and Chicago. Given also made sure it was embellished with a variety of Prince-inspired ornamentation, making his new skyscraper a veritable temple to the departed dog. The bank’s thrift affiliate, the Farmers Deposit Savings Bank, also made enthusiastic use of the animal’s likeness in its marketing, ensuring that Prince became an internationally-recognized symbol. For a good half century after his departure, Prince represented a venerable Pittsburgh financial institution to its customers far and wide.

Prince Comes to the Bank

The origins of the Farmers Deposit National Bank lay in the founding, in 1832, of the Pittsburgh Savings Fund. This was a simple mutual savings society in which members contributed small regular subscriptions. In 1841 it incorporated as the Farmers Deposit Bank and continued that way for almost twenty-five years until it reorganized under the National Banking Act as the Farmers Deposit National Bank (charter no. 685). In 1880, Thomas Hartley Given (1851-1919) became Cashier of the bank, assuming the post of President in 1893.

Prince’s story, which was recounted numerous times over the years, has the feel of a polished stone of corporate public relations. Nonetheless, there is no harm in treating the basic details of his life as if they were true. Prince, a white English bull terrier, came to the bank in the summer of 1889 from Henry Kramer, a traffic officer who worked at the corner of Fifth Avenue and Woods Street in downtown Pittsburgh (Kramer, who had just started with the force, later drove the first horse-drawn police patrol in the city and had a long career fighting crime). At the time, the bank was located at 400 Fourth Street. T. H. Given, at that time still Cashier, was a serious dog-fancier who maintained his own kennels and was active on the show circuit (a Chihuahua of his, “Carlotta”, won a First Place at a Pittsburgh show in 1899). In addition, during these years Given not only served on the executive committee of the Bull-Terrier Club of America, but hosted its meetings on the bank’s premises.

Although Prince had no pedigree, Given took a liking to the animal, and it thereafter became a mascot and constant fixture of the bank for the next nine years. Prince’s actual care was left in the hands of Chatham Gilbert, an African-American porter who in time would become the bank’s oldest and longest-serving employee. It was left to Gilbert to feed Prince twice a day, and make sure that the dog got the exercise it needed. Otherwise, Prince had free range of bank’s rooms and corridors. When the dog was not making these rounds in this way, he parked himself outside of the bank’s steel vault. At night, Prince slept on a pillow placed in front of one of the bank’s windows overlooking Fourth Avenue.

In this picture from about 1890, Farmers Deposit National employees pose with Prince.

Figure at the far left is probably Chatham Gilbert (Source: Historic Pittsburgh).

Accounts of Prince’s temperament, handed down over the years, made much of his friendly disposition towards all customers and his particular solicitude for young children, whom he was said to shepherd while their parents were busy filling out forms and transacting business. Over two decades after Prince finally disappeared, the bank put out a twenty-page booklet entitled The Story of Prince, in which the dog was described thus: “full of life and mischief, with bright intelligent eyes, always unselfish, faithful and true. Children were sure to find in him an affectionate and devoted friend.” No doubt this was some publicist’s florid copy. All the same, it is unlikely that a bank would’ve let its mascot roam like that if it did have a habit of mauling its little customers. To that extent, the story of Prince can be accepted as not disproven. Indeed, Prince comes off as something like the “noble dog” in Plato’s Republic, gentle towards those it knows but fierce towards its enemies.

While over the years Prince kept to his routine, it was not an uneventful life. Prince stood up for himself in fights with other dogs in the neighborhood, giving as good as he got. As the bank’s mascot, he represented it at various sports events when the Farmers’ Deposit men would play teams from other companies. One baseball match in particular became a regular part of Prince lore. As recounted by Edward B. Coll, a longtime bank officer, it was “ninth inning, two men on, two men out, one run needed to win. The player hit a fly ball to left field. Prince got away from the colored fellow that was holding him and started to run. The left fielder though that Prince was after him, dropped the ball, and ran away—and the Farmers won the ball game.”

Four times during his tenure Prince went missing, whether lost or stolen, only to return to his post. The bank claimed to have paid either reward or ransom money for his return. It was after the fifth time, in 1898, that Prince disappeared never to be seen again. It was said that he ran away with some of the bank employees who had enlisted in the Spanish-American War (although, at least nine years old by then, Prince himself had likely aged out of the conscription pool). Reward notices were sent to Army camps deploying soldiers to Cuba and the Philippines, but to no avail. Prince was finally gone for good.

Prince Becomes a Symbol of the Bank

The details of Prince’s life, written years and even decades after his time, can be believed or not. What is indisputable is that, for the next half century, Prince became the corporate symbol of the Farmers Deposit National Bank. By 1903 President T. H. Given had his bank moved into its new quarters on the corner of Fifth Avenue and Wood Street, a 24-story beaux-arts skyscraper known as the Farmers Bank Building. Given ensured that Prince’s memory would be incorporated into the new building’s features. The dog’s face was painted on the plate glass windows on the ground floor. Brass casts of his face were set into the sidewalks around the bank. Above all, Given had installed a marble bust in Prince’s likeness atop the keystone arch that marked the building’s main entrance. Although no photograph of the marble dog’s head is available, apparently it was large enough to be discernable on postcards produced at the time.

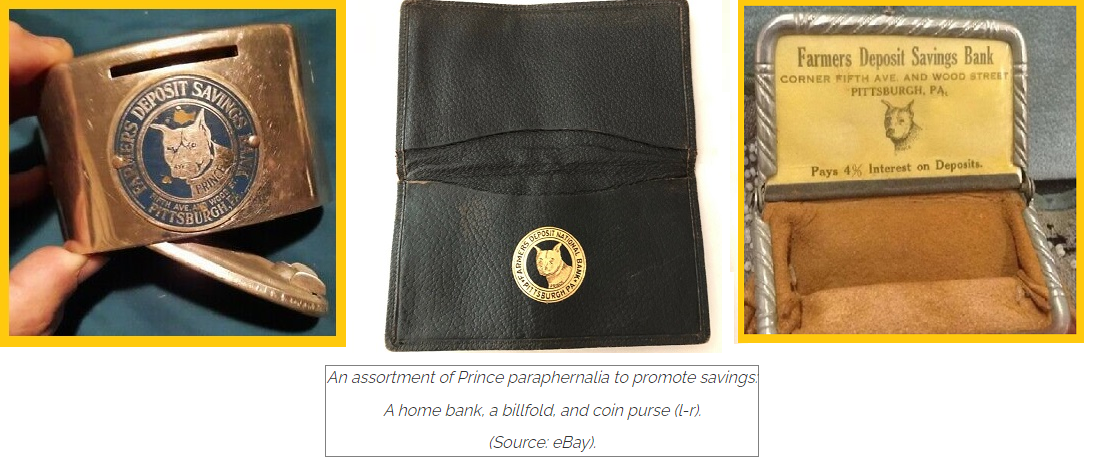

All of these ornamental flourishes are long gone, as is the building itself. Ironically, it is largely on the paper ephemera featuring Prince that his likeness survives. Prince’s face not only appeared on fiscal paper like the check and the stock certificate illustrated here, but was put to use on a variety of artifacts and trinkets that promoted the bank over the years. T. H. Given might have been the owner of the dog, but it was Edward B. Coll, Given’s second in command, who was really responsible for the marketing campaign that made use of the Prince story, and his likeness.

If T.H. Given was the discreet capitalist more suited to boardroom maneuvering, the ebullient Coll embodied the burgeoning retail arm of the Farmers Deposit bank. Until 1903, the bank did have a savings department, but as was typical of American finance at the time, nationally-chartered banks like Given’s left the cultivation of small savers to provident societies and other specialized thrift institutions like Building and Loans (B&Ls). As Coll later recounted, in 1903 Given tasked him with building up the Farmers’s thrift business through a separate affiliate. Established that year under a state charter with Given as President and Coll as Vice President, the Farmers Deposit Savings Bank operated out of the same new building that its larger sibling had just occupied.

The Farmers Deposit’s campaign to build a retail deposit base from essentially nothing can itself be regarded as a case study in the democratization of American finance. It also represented a return to the Pittsburgh’s banks own early roots as a savings society in the 1830s. In the twenty-five years that the Farmers Deposit Bank operated as a separate institution, Prince’s likeness was central to its promotion of public thrift. As Coll described it, “we use [Prince’s image] on all our windows; we use it on watch fobs for men and on brooches for ladies; on all our literature and letterheads we use this trademark.”

In pursuit of small depositors, Coll divided up Pittsburgh into districts and deployed an army of agents to solicit accounts door to door, then following up with its new customers to provide routine financial advice. Thousands of home savings (piggy) banks were distributed as repositories for small change. Birthday letters were sent to encourage the savings habit among children. After 1912, not only did Farmers Deposit engage in regular and heavy newspaper advertising, offering accounts paying 4% interest in amounts as small as $1, it also reached out to the public with its message in a variety of ways: through “moving-picture houses”, adverts on theater curtains, and outdoor signage of various sorts.

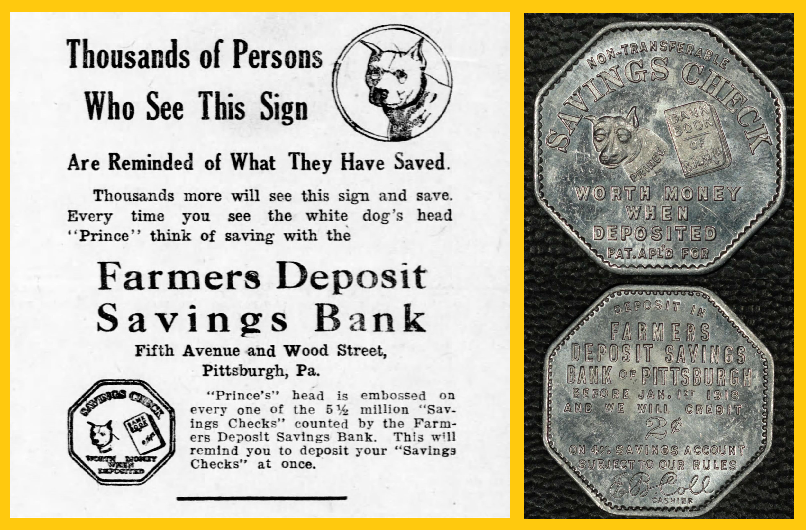

The bank’s marketing campaign piggybacked upon wider American trends in the social promotion of thrift. The government’s promotion of Liberty Bonds during World War I as a patriotic investment for the masses provided Farmers Deposit with the opportunity to link those bond purchases with the creation of savings accounts; the bank would not only finance customers’ installment purchases of bonds, but would clip and redeem the coupons on the customers’ behalf, adding the proceeds to their savings balances. In February 1915 Coll initiated a “savings check” plan that linked the promotion of consumer thrift to the burgeoning fad of premium marketing in retail trade. Octagonal aluminum tokens in seven denominations from ½ cent to 1 dollar embossed with Prince’s head were sold at face value to local merchants, who in turn gave them out to their customers at a rate of 2% of the cash value of their purchases. As the text on the tokens’ reverse explained, they could only be redeemed by depositing them in a savings account opened at the Farmers Deposit Savings Bank. Between 1915 and the end of the program three years later, Coll claimed that 18,201 new savings accounts had been creating through deposits of $41,046.80 in saving checks. Another $61, 975.11 worth of the tokens came into the bank through existing savings accounts. In all, 78% of the saving checks issued were redeemed, while the rest remained outstanding (and thus represented a small profit to the bank).

Between 1915-1918, Edward B. Coll's savings campaign for the Farmers Deposit

Savings Bank made heavy use of Prince.

By the early 20th century, such metallic token “savings checks” were used by banks across the country. Paper versions of these premium schemes, most notably the Stork System of Savings, linked together multiple banks into the same promotional program that sought, paradoxically, to encourage greater consumer spending by linking that spending to opportunities to practice thrift. Paper checks issued by the Stork System, the Northwestern Bankers & Merchants Check Company, and the Merchants Daily Savings Club, were put to use by banks and retailers in the Midwest and the Western United States.

The Farmers Deposit Savings Bank was hardly the only institution to cultivate small savers in these ways. As Richard N. Germain has documented in his history of bank marketing, beginning in the late 19th century the banking industry participated in the same marketing trends, and adopted similar advertising practices, as did other consumer-facing sectors of the economy. Branding as an aspect of consumer marketing became an important tool in the efforts by banks to build their deposit bases. No longer was it enough for banks to simply publish tombstone ads that listed their latest financials for deposits, loans, reserves, and surplus profits, as if data alone were sufficient to gain customer traffic. Instead, banks increasingly invested in cultivating the proper image that would attract deposits.

In an era before the widespread provision of consumer credit, banks targeted the public not as potential borrowers, but as savers. At the beginning of the 20th century a commercial bank, particularly one with a national charter, did little lending business with ordinary individuals other than take their money on deposit. Legal restrictions kept national banks largely in the business of short-term commercial lending, leaving investment and mortgage banking to other institutions. However, acquiring or starting a savings affiliate (as the Farmers Deposit did) would give commercial banks access to the resources of a wider deposit base. But what marketing strategy would banks use to sell thrift in ways that were akin to peddling detergent or automobiles to a burgeoning middle class?

To answer this question, the financial press devoted regular space to the discussion and analysis of bank advertising, offering critiques of its layout, the quality of its copy, and the effectiveness of its symbols. The challenge was to communicate sober qualities like safety, reliability, and dependability in a fashion that caught readers’ attention. Almost by default, banks incorporated pictures of their buildings into their advertisements as emblematic of the bankerly virtues they sought to signal. The very architecture of those bank buildings, especially variants on the classical style as it appeared on main streets across small-town America, communicated messages about a bank’s qualities that might translate into print advertisements. Likewise, pictures of a bank’s massive steel vaults sought to reassure depositors about the safety of their funds—even if those deposits were not actually held in the vault, but lent out in the ordinary course of the bank’s business.

What made Edward Coll’s campaign to build his bank’s deposit base stand out were two things. First was the figure of Prince itself. As a columnist in Bankers’ Magazine averred in 1908, “a dog’s head is rather an unusual emblem for a bank.” Soon after that, Prince’s likeness was showing up on all manner of souvenirs distributed by the bank, as well as its correspondence. Coll explained, “this story about Prince may seem to be superfluous or sentimental, but in reality it has proved an effective piece of advertising.”

Indeed, Prince’s legacy proved important for the second strength of Coll’s marketing strategy, which was banking by mail, begun in 1913. Although not the first Pittsburgh bank to solicit accounts in this way (the Pittsburgh Savings Bank started its program as early as 1898), the Prince image helped the Farmers Deposit Savings Bank to reach an international market. As Coll estimated in 1917, over three-fifths of Pittsburgh’s residents were either foreign born or the offspring of first-generation immigrants. Overseas remittances were thus a valuable service to the city’s small savers. Money orders drawn on the bank, featuring Prince’s likeness, brought it international recognition. Immigrants later showing up in Pittsburgh, who might otherwise speak little English, knew to ask for the whereabouts of the “dog bank.”

The bank’s formal chronicle of their mascot, The Story of Prince, which appeared in 1920, bragged in almost Churchillian cadences about the international marketing success of its canine trademark:

You may find “Prince” in the oil fields of Burma, East India; in the gold fields of Johannesburg, South Africa; on the battlegrounds of France; in Bangkok, the capital of Siam; in the land of the head-hunters in the Philippines; in China, the far-away country of the Orient; and even in the blue depths of the ocean, for two of our depositors are sailors in United States submarines.

Thomas Hartley Given, who had headed both the Farmers Deposit National and the Farmers Deposit Savings Banks, passed away in 1919. Since Given was their chief stockholder, his death precipitated a restructuring of both entities. The savings bank merged with the Union Trust Co. to form the Federal Deposit Trust Co., with Edward Coll moving from the Cashier position to President. Later, in 1928, the two banks re-merged as the Farmers Deposit National Bank. Coll continued on as a Vice President of the combined institutions. By this point Coll could look back with some pride at his stewardship of the savings campaign. Under his watch the bank’s deposit base went from nothing to $14 million, comprising some 50,000 accounts of small savers.

The Slow Demise of Prince

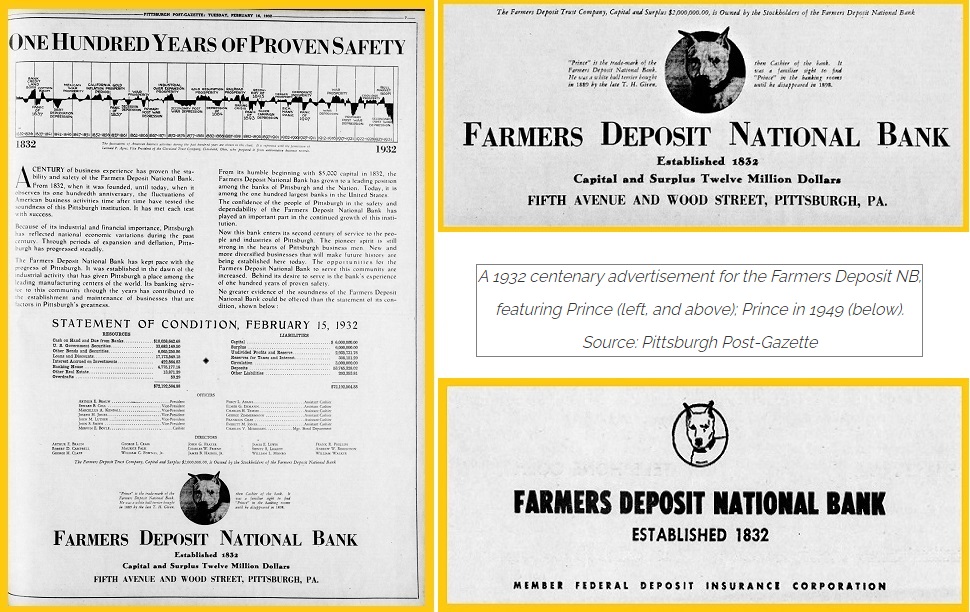

After the merger, Prince’s role in promoting thrift receded, although the dog’s portrait remained the official symbol of the bank. With the economic hard times that soon descended upon the country, encouraging thrift was hardly a priority, either for individuals or for the public at large. Questions of sheer survival, especially for institutions like banks, became paramount. In February 1932, near the depths of the Great Depression, the Farmers Deposit National Bank celebrated its centennial year with appropriately sober advertising that confirmed to Pittsburghers that, yes, the bank was indeed alive, providing newspaper readers with a helpful, graphical representation of all the business cycle ups and downs that the bank had previously survived through. And for this latest economic trough, Prince was on hand, there again to reassure the public that his canine virtues remained at its service. As The Story of Prince put it, “the one absolutely unselfish friend that a man can have in this selfish world, the one that never deserts him, and the one that never grows ungrateful or treacherous, is his dog.”

If persistence, indeed ‘doggedness’ and loyalty are canine virtues, then Prince’s corporate icon displayed them by its sheer longevity. The advancing years did bring wear and tear to the Prince iconography. When an ear fell off the carved marble head of Prince that T. H. Given once had mounted over the Fifth Avenue entrance, a new one had to be carved. Undaunted, Prince’s image persisted on the bank’s plate glass window, and still graced the bank’s stationery. Edward C. Coll, the bank officer behind Prince’s corporate apotheosis, passed away in 1949, a full thirty years after the death of his boss (and Prince’s owner) T. H. Given. Yet even by then, the Prince trademark was still in use by the bank, at least in its newspaper advertisements.

Nonetheless, there had been premonitions that Prince’s longevity had a limit, beginning with the announcement in March 1946 of the acquisition of Farmers Deposit by the Pittsburgh National Bank. Although Prince’s institution was to be swallowed up by the Mellon interests, the two banks would remain in their separate buildings for the time being. The end of Prince’s reign came in 1950, when the Farmers Deposit National Bank merged with the Mellon National Bank and Trust Company. In 1953, most features of Prince were removed from the Farmers Bank building after it was purchased by a New York developer and remodeled, although at least a plaque was promised on the building as a small preservation of Prince’s memory. Thereafter, however, the building aged badly, growing functionally obsolete. In the 1960s it lost its beaux-arts ornamentation to a utilitarian resurfacing and became better known to Pittsburghers as the host of a large mural celebrating the city’s sports heroes. With Prince long gone, the building itself came to an end on a rainy day in 1997, with the controlled implosion of the structure to make way for a department store. With that, all public traces of the “watchdog of the treasury” were gone.

A Postscript for Chatham Gilbert

Although the actual dog disappeared decades earlier, Prince persisted in myth and marketing as a denizen of the Farmers Deposit National Bank. In this way, Prince outlived all the humans who had made him a part of that bank’s story. He outlasted T. H. Given, the bank officer who first brought him onto the bank’s original premises. He outlasted Edward B. Coll, the marketing man who had burnished the memory of Prince into an enduring corporate identity. Finally, the dog survived beyond the life of the third and final person who was integral to Prince’s life and story, and that was Chatham Gilbert, “the colored fellow” referred to by Coll—the individual had the responsibility for actually taking care of Prince.

Thomas H. Given, the white bank president, and Chatham Gilbert, the black porter, lived in the same city and worked for the same bank, but otherwise inhabited separate worlds. In addition to his bank duties, by the time of his death Given owned two newspapers, the Pittsburgh Press and the Pittsburgh Sun, and served as an executive officer, and on the board of directors, for numerous industrial companies. He also helped establish the Reliance Life Insurance Company. Given, along with an associate, put up the venture capital for Reginald A. Fessenden, the Canadian-American inventive genius who was a central figure in the early, tumultuous and cutthroat years of the radio industry. Despite his stature in Pittsburgh’s business community, Given was a private man who avoided the society limelight. He married at middle age and had no children of his own.

In contrast, Chatham Gilbert occupied no corporate directorships, but he and his wife Frances did have a substantial family of four daughters. Born in Prince Georges County, Maryland, in May 1857, Gilbert later lived in Alexandria, Virginia, working as a brickyard hand. There he met and married Frances Edmonds in about 1883. They moved to Pittsburgh by 1888, the year their first daughter was born. Gilbert was listed in city directories of 1888 and 1889 as a laborer; in 1890 his occupation was given as janitor, and this change probably marked the beginning of his forty-five career at the bank that ended only with his death in February 1935.

Gilbert’s job description at the bank cycled through a number of menial occupations open to African-Americans at the time. During the “Prince” years of the 1890s he probably continued to work as a janitor, which was also his given employment in the 1900 census. Thereafter, city directories described him as the bank’s messenger and its porter; he appeared in the 1910 census as a messenger. By the late teens he was again identified as a messenger; this was also the occupation given in both the 1920 and 1930 census.

Outside of the bank, Chatham Gilbert was also a reliable figure in his community. For over thirty years he served on the Board of Trustees of the John Wesley A.M.E. Zion church. During a period in Pittsburgh’s history when black fraternal organizations were vibrant, Gilbert was an active club man. He was a brother in the Oriental Lodge no. 65 of the F & A.M. (Prince Hall Masons). He was a longtime member of the Eureka Lodge #1436, and of Patriarchie No. 39, of the Grand United Order of Odd Fellows. Gilbert served as both Treasurer of the GUO of OF and as a Deputy District Grand Master of the order, responsibilities that involved travel to and participation in state and national assemblies.

If T. H. Given and Chatham Gilbert occupied separate worlds, those worlds at one point intersected in the figure of Prince. Given, the dog-fancier and show competitor, was the creature’s owner. Yet Gilbert was the human who actually took care of the animal. During his early years as a janitor and porter, Gilbert fed, bathed and exercised Prince, and must have been his minder on outings like the storied baseball game that became part of the Prince lore.

Prince vanished in 1898, but Gilbert remained. Gilbert continued at his posts even as the myth of Prince was spun by others into an elaborate corporate symbol. As he grew older and frailer, Gilbert’s responsibilities at the bank became less strenuous. He kept on working as a messenger and then finally as a guard. It seemed lucky for him that, as the Great Depression swept through industrial Pittsburgh, he was able to hold on to his job at the bank. By the 1930s, as Gilbert’s employer celebrated its centennial, city directories listed him as a bank guard, even up until 1934, the year before he died. By this time, Chatham Gilbert was a man well into his seventies who had already buried one daughter and who had to care for a wife with advancing senility, besides. Almost to the very last, he must have risen in the mornings, pulled himself into whatever uniform the bank required, and appeared on its premises to perform his duties. Prince may have been styled as the “watchdog of the treasury”, but it was Chatham Gilbert, Prince’s old caregiver, who lived out his days as the actual sentinel of the Farmers Deposit National Bank. For that he should also be remembered.

REFERENCES

Ancestry.com, for various information from U.S. censuses, city directories, and death certificates for Chatham and Frances Gilbert.

Anonymous, “How Banks are Advertising” Bankers Magazine (March 1908), p. 399; (June 1914), p. 697.

Anonymous, "75 Years of Bank Promotions" Bank Marketing (October 1990), pp. 10-14 [Immigrants refer to the "dog bank"].

Advertising Age, January 10, 1938, p. 32.

Bottles, Rich “The Farmers Dog” PATCO Journal (November-December 1994), pp. 27-28 [describes the savings check plan].

Coll, Edward B., “Teaching 12,000 to Bank by Mail: A Pittsburgh Savings Plan that Draws Deposits from All Corners of the Globe” Burroughs Clearing House (March 1917), pp. 9-12.

----- “Savings Bank Service” Bulletin of the American Institute of Banking (April 1922), pp. 191-195 [explains check savings plan].

“Keeping your Bank in the Public Eye” Bankers’ Monthly, March 1920, pp 56, 106 [extensive quotations from “The Story of Prince”].

Forest and Stream, November 2, 1895 [T.H. Given and the Bull Terrier Association].

Germain, Richard N. Dollars Through the Doors: A Pre-1930 History of Bank Marketing in America (Westport, CT: Greenwood Press 1996).

Macgregor, Theodore Douglas, Bank Advertising Plans: A Book of Practical Suggestions (New York: Bankers Publishing Co. 1913), p. 193.

-----, Bank Advertising Experience (Detroit: Burroughs Clearing House 1919), pp. 255-257.

Mason, David L. “At the Intersection of Economics and Culture: The Thrift Industry and Progressive Era Reform” Essays in Economic and Business History (2000), pp. 149-161.

Montgomery, E. S. The Bull Terrier. A Comprehensive Treatise on the History, Management, Breeding, Training, Care, Showing, and Judging (New York: Orange Judd 1946).

The New Era [Lancaster, PA], March 25, 1902 [notes Chatham Gilbert is District Deputy Grand Master of the G.U.O. of O.F.].

The New York [NY] Age, February 23, 1935 [obituary notice for Chatham Gilbert].

Pittsburgh Courier, February 23, 1935 [obituary notice for Chatham GIlbert].

Pittsburgh Post-Gazette, June 29, 1919 [obituary for T. H. Given]; November 26, 1949 [Prince logo still in use]; December 2, 1950 [Farmers Bank now a Mellon unit].

Pittsburgh Press, August 22, 1897 [first mention of Chatham Gilbert on the Board of Trustees of the John Wesley A.M.E. Zion Church]; May 26, 1903 [state charter granted to Farmers Deposit Savings Bank]; March 28, 1909; [Chatham Gilbert is state treasurer of the G.U.O. of O.F]; June 29, 1913; September 19, 1919 [restructuring after Given’s death]; March 20, 1928 [merger of the two Farmers banks]; May 5, 1928 [complete story of Prince]; February 16, 1932 [centenary advertisement]; March 14, 1946 [ Farmers acquisition by Mellon interests]; February 28 1948 [half century of the Prince symbol]; December 2, 1950; December 15, 1953 [Prince’s features removed from building].

Pittsburgh Sun-Telegraph, May 4, 1946

Turf, Field and Farm, March 10, 1899, p. 261 [T.H. Givens and his Chihuahua “Carlotta”]