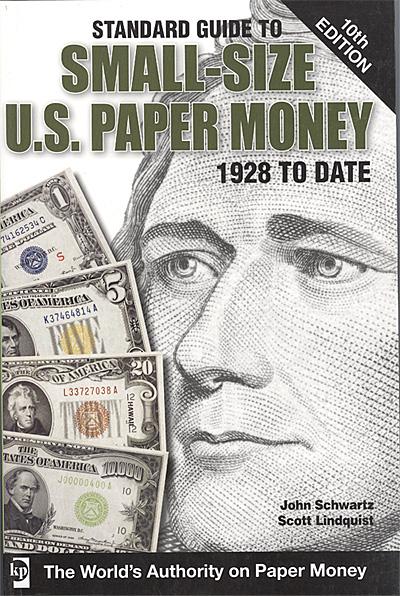

In this month’s article I will explore the vagaries of pricing along with the calls and emails I get whenever I lower the price on a note in “The Standard Guide to Small Size U.S. Paper Money, 1928 to date” (SGSS). This seems to be a common occurrence with each new edition of the SGSS. Interestingly, however, I don’t remember anyone ever calling to inquire about a price that went up! The question and answer exchange below regarding a specific price decrease caught a SGSS reader a bit off guard.

“Scott,

Hello. I ordered and have been comparing your 10th edition to the 9th edition. I was just wondering why quite a few listed prices are lower in the newer 10th edition than the older 9th edition. I would think the values would increase instead of decrease with time. For example, in the 9th it lists a 1929 $50 Cleveland star note at $750 in VF where the 10th lists it at $600. That is just one example, but throughout I noticed most listings were lower in value than the last edition. Just thought I’d ask.

Thank you, Erik”

“Hello Erik,

Your question is a good one and I get it all the time as it is a common misconception, mostly from the relatively recent entries into our enjoyable collecting hobby. I will be reprinting portions of this response, (without your full name of course), on the Society of Paper Money Collectors blog and perhaps my own news and update page on my website.

First off I have never been in any market where prices only go up. A healthy market has both ups and downs. The previous 9th edition of the SGSS was compiled at the end of 2008 when prices were much higher. The recession has hit VF to CCU grades on the more available and generic material. But if you keep looking you will see many price increases as well. In general all prices have auction and sales records to back their drops or increases in value.

A price guide that only goes up in value every year will eventually lose all the confidence of the users as soon as it doesn't represent the realities of the market. One would have to put this kind of price guide in the dubious category as the author would appear to have an agenda separate from the market and price realities. I have seen this happen in the past with other price guides and the end result is a free fall in prices and a marketplace that has no trust in the pricing. This can further erode prices lower than they would have fallen in an economic recession without the dubious price guide. I have also seen this erosion in confidence of well edited price guides that just go ahead of the market too quickly or, and this happens often, the static price guide can't react to a sudden drop in prices as compiling and publishing is a huge task and may take a year from start to finish.

Look further, you will see as many ups as downs. To feel prices only go up is wishful thinking especially considering our recent economic troubles. I have to wonder what time frame you are using for your price expectations. Prices have just started recovering on some of the higher grade and rarer material as I write but nowhere near the peak price period of the Flynn sale in April 2008.

In the case of the $50 1929, FRBN, D* block, the most recent sales of VF-20 to 25 certified notes have consistently brought two thirds the previous price guide level at $460. There are three or four auction price records at this level from June and November 2010 Bowers sales. The previous auction price was $661 for a VF 20 in 2007. This information validates the 9th edition pricing as well as the 10th edition pricing. Auction prices can, for all practical purposes, be considered wholesale prices or replacement cost for a dealer to restock the item. So add approx. 20 % for a retail expectation for a note of this value. I do my best not to raise or drop prices too quickly if the market and economic conditions will allow it. A conservative approach to pricing is the best one and that is the way I have priced this guide since I have had final editing privileges on pricing.

Editing the prices in the SGSS is a balancing act of sorts and the only subjectivity that may enter into the pricing structure or template may be the nature of the economy and the current economic outlook. When the publisher asked us to deadline the past 9th edition the economy was in free fall so I purposefully muted those peek highs. If I had not, the price drops in the 10th edition could have been much steeper.

In closing I will repeat a common theme in all the SGSS editions I have worked on for free or minimal remuneration for these past 6 editions. This is only a guide and it is an approximate retail price at the time of publication. The purpose of a price guide is to keep a fair benchmark of the market place so that retail buyers and wholesale dealers can transact business with confidence. It is not the purpose of this price guide or its authors to lead the market. That would be a dangerous strategy and one, as a dealer, I would think would cast serious collector doubt on the whole price guide. The purpose of this price guide is to follow the market. For that reason a price can and will, over a period of months or years, be higher or lower than the prices listed in this book. I don't control the pricing I only keep the score. It is up to the marketplace, where sellers and buyers negotiate current values, to decide the price at any given time in the future.

I take this task very seriously Erik. I do not do this for the small fee I earn. One of my good friends in the business asked me why I continue to do it as the thousands of hours I put into it seems to increase with each edition. My response ‘I wouldn't trust it if I didn't do the pricing’. We all need a well researched price guide as a reference. No one more so than myself. I don't mind the reader challenges on the pricing as I always have empirical, provable, data as in your case. If I didn't I couldn't expect the trust and respect of the industry that I have worked my 30 years as a collector/dealer to obtain.

A price guide that is trusted and accurately researched will go a long way to increasing the interest in this wonderful collecting pursuit. As more and better informed collectors enter the market demand will increase, taking prices higher. It is my sincere hope that this guide continues to attract more new collectors and to increase the confidence in all of those who have used it for well over a decade. In that way only do I serve myself, in the hope that interest grows and along with it my business which feeds a healthy, informed and growing pool of collectors.

Sincere Numismatic Regards,

Scott Lindquist”

This email exchange piqued my curiosity about a couple of trends. I can’t help but wonder if there were more decreases than increases in prices between editions of the SGSS. I really have no idea since I price by the current market and I don’t keep a tally of increases or decreases. [(An industrious reader might want to do the necessary research here and report back to me.)] My general sense is that the prices overall go up, but this could be distorted by the new Gem columns which at least 90% of the time show an increase over the previous CCU price.

There are no secrets to my approach to pricing in this guide. For major corrections in value I make those changes while I am doing the research for the Gem price column. In some cases the old CCU price is the current Gem value, so the CCU price must come down. Remember it was not that long ago the price column for the highest grade notes was only CU. It was changed in the 7th edition (2006) to CCU at my urging to more accurately reflect the changing marketplace trends. And this was before the Third Party Graded (TPG) numbers game of 1 thru 70 fully impacted the collecting and dealing psyche. Things have really changed over the last decade.

No one likes the sudden shock of a 30% price drop or more due to economic or other factors in our marketplace. This combined with the increased popularity of TPG certified Gem 65Q and higher grade notes has caused some severe price increases in Gem, but a corresponding double hit to the CCU price which has dropped because of less collector demand as well as the recession. The decrease in demand for TPG notes graded 64, 63 or less was dramatic and those that bought a year or two ago are likely to be rewarded. I and other dealers and collectors could often buy a 63/64Q (the Q is for the original paper quality designation of PPQ and EPQ on TPG holders) for what we used to pay wholesale ten or more years ago! Incredible bargains were had by many when they showed up in auction and elsewhere. There are still a few bargains out there in the CCU marketplace, but the prices already are starting to correct upward.

Next month I will look more closely at the difficultly in pricing rare varieties with infrequent public sales. Or, if the readership wishes, we can delve into the thorny issue of dealer and collector involvement in hobby price guides, and the potential for bias and self serving entries.

Lastly there needs to be a ‘correction’ of sorts in the SGSS regarding the 2006-2006A $100 Federal Reserve Notes due to some very strange happenings with the problem riddled production of the ‘NextGen’ (colorized 2009 series) hundreds. I discuss this more fully at www.scottlindquist.com under the News + Updates tab. In short, since this article is getting lengthy, please note that the figures and listings for these contemporary hundreds are very confusing because of the sudden appearance of the 2006A series. The 2006 and 2006A series are one in the same and only indicate cessation of the 2006 series production in expectation of the 2009 NextGen notes to follow. When this did not happen due to production problems with the colorized 2009 series, production needed to be restarted for the 2006 series, with the 2006A designation, but with the same design and signatures as the 2006 series. This is certainly a strange development and one that had myself and many other collectors scratching their heads in puzzlement over this unprecedented series designation decision. More to come in future articles as details develop.

Images