Please sign up as a member or login to view and search this journal.

Table of Contents

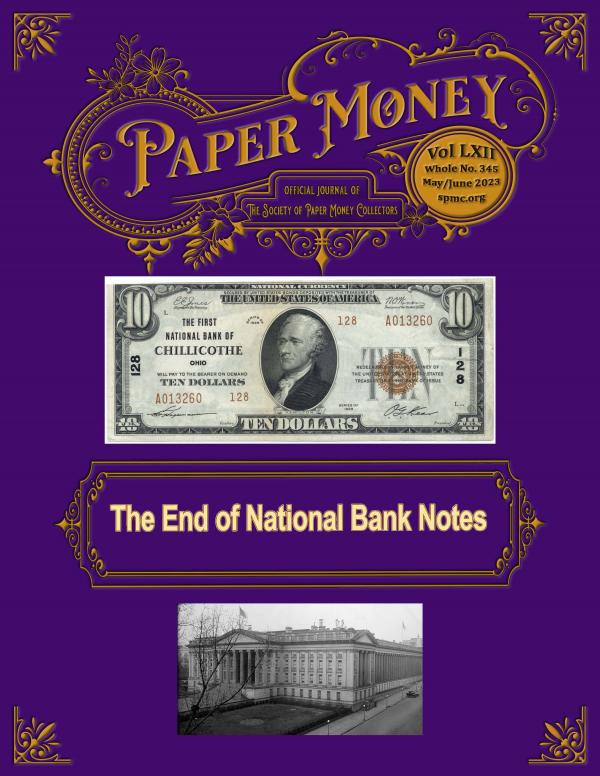

The End of National Bank Notes--Lee Lofthus

Digital Archives of the Walton Collection--Matt Hansen

Back Plate 470 Discovery--Peter Huntoon

Laws Governing the Circulation & Denominations of NBNs--Peter Huntoon

William Morris Meredith--Rick Melamed

Challis Idaho Territory Postal Note--Bob Laub

Fairbanks, AK Bankers--Frank Clark

SPMC On-Line Showcase of NBN Collections--Matt Hansen

UNESCO World Heritage Sites--Albania--Roland Rollins

The Exchange Note (Billete de Canje) of Puerto Rico--Angel Zayas

Notes of the Farmers & Mechanics Bank--Gerald Dzara